Stocks I Bought September 2024

A review of the stock market and my moves - Month 1

Major Indices VS My RRSP

The four major indices were pretty much straight up this month with the low points coming in at the tail end of the first week. The S&Ps lowest close of the month was September 6th 2024 and the highest fell on the last day of the month.

The big winner of the indices was the Nasdaq 100 and the biggest winner for my RRSP tickers was VTI by a very narrow margin. In the future I may look at counting dividends to give VDY and SCHD a fighting chance.

| Ticker | Index | 2024-09-01 | 2024-09-30 | Percentage Gain |

|---|---|---|---|---|

| .INX | S&P 500 | 5528.93 | 5762.48 | 4.22% |

| .IXIC | Nasdaq 100 | 17136.3 | 18189.17 | 6.14% |

| .DJI | Dow Jones | 40936.93 | 42330.15 | 3.40% |

| TX60 | TSX 60 | 1386.5 | 1438.82 | 3.77% |

| Ticker | My RRSP ETFs | 2024-09-01 | 2024-09-30 | Percentage Gain |

|---|---|---|---|---|

| VDY | FTSE Index CAD | 46.65 | 48.2 | 3.32% |

| XAW | Many Indexes | 41.39 | 43.02 | 3.94% |

| SCHD | Subset of Dow | 27.93 | 28.18 | 0.90% |

| VTI | Total US Market | 272.39 | 283.16 | 3.95% |

My Moves

Like a typical month I did most of my buys in two groupings. I generally buy in my TFSA in the middle of the month with my first pay cheque and then I buy in the RRSP at the end of the month. This allows me to DCA on at least a biweekly basis.

I did not sell any positions this month. One thing to note is my RRSP does have fees for trades being with a traditional broker where as my TFSA does not. With this in mind I sometimes buy in chunks in the TFSA or as dividends come in. One last thought before the big reveal… during the past two years we have had major dips in September and October followed by big rallies into year end. I did end up spending a fair amount of time thinking about that fact, likely more than I should have.

TFSA BUYs

- VFV

- My TFSA was definitely overweight in Canadian stocks so I opened a position in VFV back in May and continue increase it.

- PSA

- Decided to hold some cash in this High Interest Savings (HISA) ETF just incase there is a dip

- We have also been keeping some of our emergency funds in HISA’s to help keep up with inflation

- ETHY

- I still believe long term in ETH so I averaged down

- HXQ

- I’ve realized like many Canadians I am underweight technology. Yes it would have better if I realized this years ago but now is better than never.

- PLTH

- This is a small moonshot position for me. Part of it is banking on the upcoming Florida Amendment 3 vote on November 5, 2024. This would allow full legalization of MJ for anyone over the age of 21. Q2 earnings were pretty soft but as rate cuts have begun I believe this will improve in Q3.

RRSP Buys

Before I made my RRSP purchase I thought about how potentially delaying the buy as the past two years I have bought heavy in September only to see the market drop all October. Since I knew VTI was what I wanted to buy I decided to go ahead and start my currency conversion through Norbert’s Gambit.

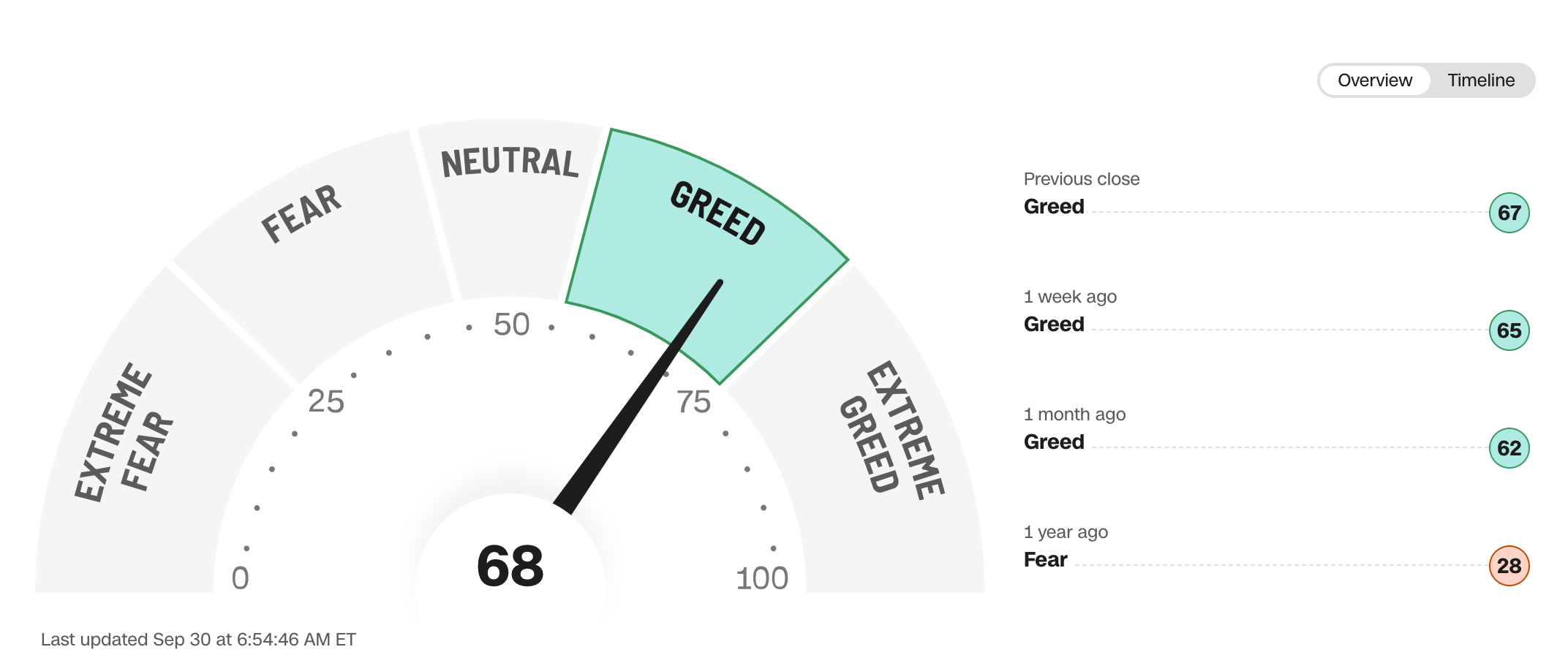

Once that went through, it took about 2 days, I waited one more day before thinking to myself this year we are in entirely different financial conditions. This is easily shown by a quick glance at the old greed fear index.

- this year we are at 68 or the high end of greed and last year we were fearful borderline extreme fear

Dividend Increases and Decreases

Note: Many of my holdings are in ETFs that have varying distributions from one to the next so I’m not expecting that much dividend growth here. (also hopefully zero decreases but I’m still holding AQN)

- Decrease on AQN from 0.108 -> 0.065 for the upcoming payouts in October and January. Really wish I sold this one

Remember folks “Time in the market beats timing the market”

That’s all for this months review thank you for reading. I hope you enjoyed my thoughts and progress this month!