5 Steps to Financial Freedom

My 5 goals along the path to Financial Freedom maybe even F.I.R.E.

Step 1: First $100,000

You are now saving and hopefully investing your hard earned money in a reasonable fashion. For me that is mostly indexed ETF equities, an emergency fund in a High Interest Savings Account and a small amount (<5%) of riskier bets such as single tech stocks and crypto. This is amazing and you will need to keep it up until the arguably toughest step in this list… your first $100k

Now what is it that makes the first $100k so difficult to achieve? I plan on making a blog post purely diving into this topic but it essentially boils down to two things:

- You need to build the habit of saving as much as you can each month (and not spending it once you hit say $50k on a new car).

- Your contributions far out weigh the amount that your money earns.

How do you get there?

The only way to get there is to increase your savings rate which can be done in essentially 2 ways:

- Earn more while keeping your spending flat.

- Spend less.

Early on in my career shortly after I moved to the city of Toronto a good friend of mine was going through this procedure. He had just received a small raise and was unable to negotiate it much higher at the time. After that his only option was to look at his expenses during which time he realized if he could find a place with rent for $500 less per month that would be the equivalent to a $10k raise.

- The reasoning behind this was $500 * 12 / 65% = $9,230.76

- 65% is used because the marginal tax rate was 35% at the time so he would only be able to keep 65% of the salary bump.

- This was something I never thought in this much detail before but it is yet another example of “It doesn’t matter how much you make, what matters is how much you save”

Examples

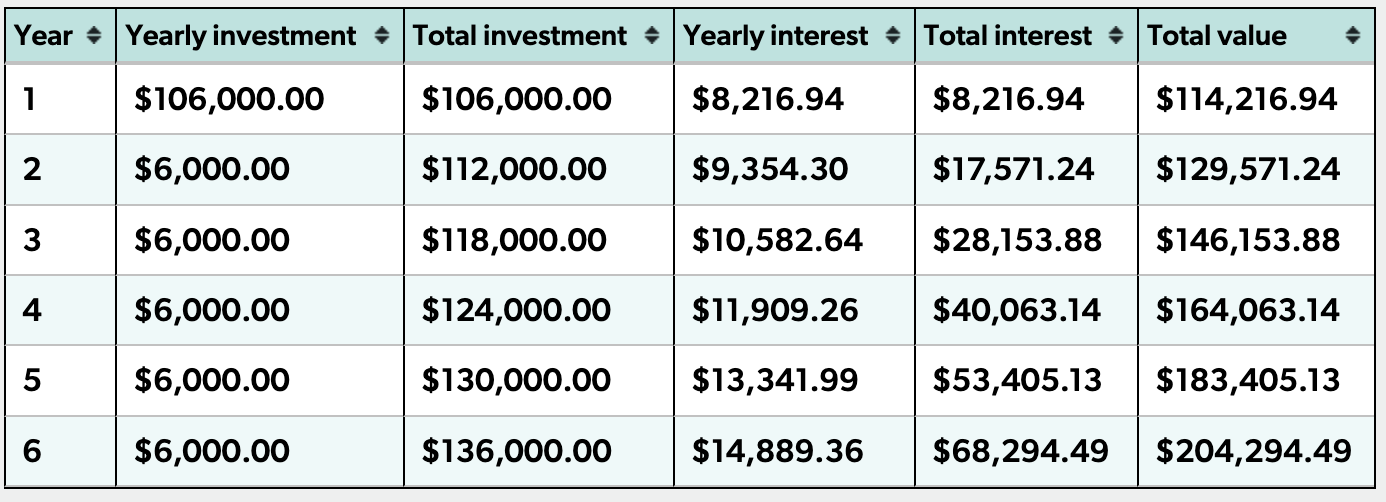

$500 a month 8% interest compounded annually

Time to bust out one of my favorite tools the compound interest calculator. Let’s say you are like my friend and are able to save an extra $500 a month. You will be in your 11th year when you hit the elusive $100k. You have contributed about two thirds of the value and earned only one third in interest.

However to get your second $100k for a total of $200k it will only take 6 years.

- Note: If we were to continue the chart above to reach 200k we would be in year 17 and would have contributed 50% and earned 50% in interest.

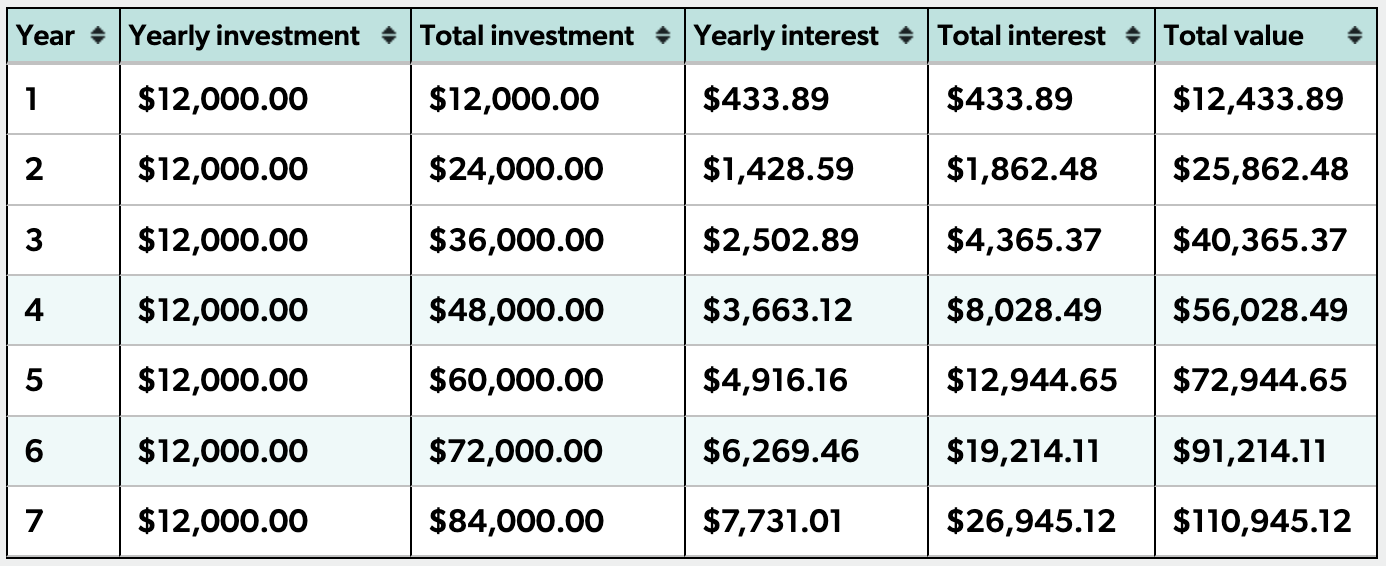

$1000 a month 8% interest compounded annually

Let’s take a look at if you were able to increase your income by $500 a month and save $500 a month.

So if we doubled our monthly contributions it would take 60% of the time to reach $100k and we would be 75% contributions and 25% interest.

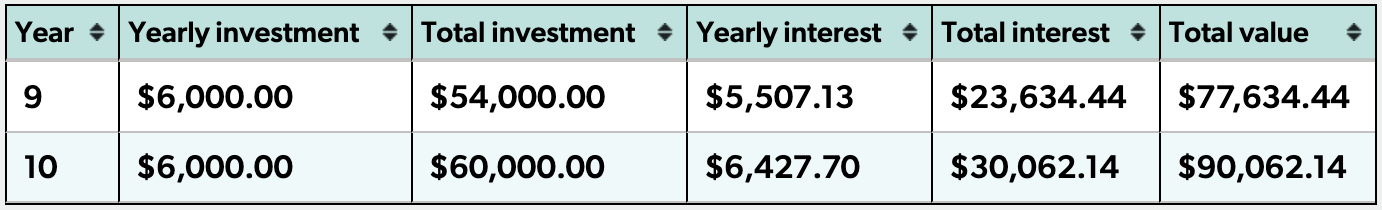

Step 2: Your Invested $ Out-Saves You

This step is the definition of “Money makes Money” and my current goal. Over the years your contributions will change hopefully in an upwards direction but you may run into hard times or have a major life event that requires you to lower your contributions for awhile. This is all ok and is completely normal. The true power of reaching this stage is when these events happen your money is still growing in a meaningful way.

Looking at the example from above $500 a month making 8% compounded annually, this will happen in your 10th year.

I typically like to use 8% as an average return to be slightly conservative but let’s say you were 100% invested in VOO over the last 10 years you would have had an average return of 12.94% at time of writing.

$500 a month making 12.94% compounded annually, this will happen in the 7th year.

Step 3: First liquid $1,000,000

I’ve read some articles that split first $1,000,000 and first liquid $1,000,000 out but personally I’d prefer to think of my home as more of a utility and not as an asset. The first time I heard this idea was when I read Rich Dad Poor Dad from Robert Kiyosaki, many years ago. In retirement if you are downsizing and sitting on equity in your home you can pull that money out to fund your new residence. Hopefully you will be able to pull some money out of it but you never know.

I’ve heard people say $1,000,000 is not as big of a deal as it used to be and personally I don’t think that’s fair. While it is technically true due to inflation a million dollars today is not the same as a million dollars in 2004, it is still an incredible milestone and should be celebrated. [Although not too hard else you dip back into the 6 figures!]

Step 4: Yearly gains equal your earned Income

Important thing to call out here is that your average yearly gains equals your earned income. If we have a blow out year like 2019, 2021 or 2023 where the S&P 500 returns in the mid to high 20% range thats awesome. However, this is not the norm. Best to take you average percentage returns over 5-10 years before you can confidently check this box!

Note: Depending on your income Step 3 and Step 4 may be interchanged.

Step 5: Financial Freedom

The final stage you made it! This is the point where you are confident that your yearly gains are well above your previous income or at least well above your needs.

Before you pull the rip cord, I have been given many pieces of advice that I will pass along to you in three buckets

- Triple check you have more than enough to support your lifestyle with a good margin of error - Perhaps in early retirement you still have supplementary income

- Ensure you are using the right sources of income in the correct order / breakdown. This is very much dependent on your own situation and it is likely worth meeting with a Financial Planner or Advisor to discuss. - I know the general consensus is DYI investing now and I too am a DIY investor however advice on kicking off your retirement couldn’t hurt.

- A wise man once told me to be happy in retirement you need at least 3 year round hobbies. If some of your hobbies are seasonal thats fine just make sure you have 3 for every season.